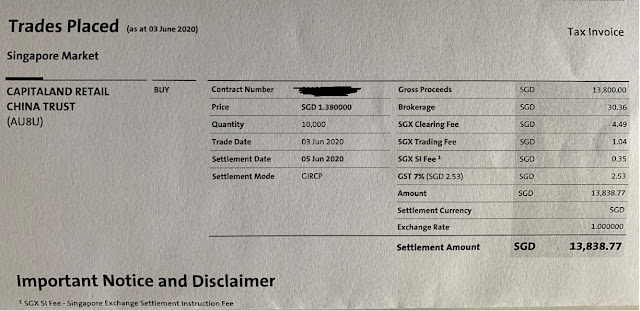

On 3rd June 2020, bought 10,000 shares of CapitaLand Retail China Trust at $1.38 per share.

Previously I had disposed the shares due to Covid-19 occurred in China on 2nd of January.

Currently, China not only managed to bring the virus under control and is in the process of developing 5 different vaccines and with 1 type of the vaccine development at Phase 2 Human Trial. The last trial will be Phase 3 before a vaccine could be approve and proceed into production mode.

I strongly believe China will be the first country to introduce a successful vaccine to the World and I will like to mention how China managed to test Wuhan City of 9.8 million out of 11 million residents within a span of 18 days for Covid -19 and discovered 300 asymptomatic people .

The efficiency and speed of Chinese Government is astonishing who places her citizens health the first priority. The contrast between China and USA is very great when dealing with Covid -19.

All of the malls have reopen on early April , though it’s income will be affected during lockdown period in China and I estimate the yield will still be about 7% based on my entry price.

This black swan event again highlights the importance of having a second income besides income from regular job. We can clearly see employee being placed on no pay leave, taking pay cuts or got retrenched and especially older workers being the most vulnerable.

As for Singapore , we are on the way to reopening in stages but full circuit breaker can be introduce again if the community cases rise sharply.

Elections could also be call this year because each delaying days will put the ruling party at risk of losing more votes and favor the opposition parties.

This is no doubt this is greatest challenge our Nation faced since independence and I believe with perseverance and courage ,we can come out from this and emerge stronger than before.

Majulah Singapura , Majulah Singaporean!

Previously I had disposed the shares due to Covid-19 occurred in China on 2nd of January.

Currently, China not only managed to bring the virus under control and is in the process of developing 5 different vaccines and with 1 type of the vaccine development at Phase 2 Human Trial. The last trial will be Phase 3 before a vaccine could be approve and proceed into production mode.

I strongly believe China will be the first country to introduce a successful vaccine to the World and I will like to mention how China managed to test Wuhan City of 9.8 million out of 11 million residents within a span of 18 days for Covid -19 and discovered 300 asymptomatic people .

The efficiency and speed of Chinese Government is astonishing who places her citizens health the first priority. The contrast between China and USA is very great when dealing with Covid -19.

All of the malls have reopen on early April , though it’s income will be affected during lockdown period in China and I estimate the yield will still be about 7% based on my entry price.

This black swan event again highlights the importance of having a second income besides income from regular job. We can clearly see employee being placed on no pay leave, taking pay cuts or got retrenched and especially older workers being the most vulnerable.

As for Singapore , we are on the way to reopening in stages but full circuit breaker can be introduce again if the community cases rise sharply.

Elections could also be call this year because each delaying days will put the ruling party at risk of losing more votes and favor the opposition parties.

This is no doubt this is greatest challenge our Nation faced since independence and I believe with perseverance and courage ,we can come out from this and emerge stronger than before.

Majulah Singapura , Majulah Singaporean!

Comments

Post a Comment